KFH Reinforces Community Role with Comprehensive “Increase Good Deeds in Ramadan" Campaign

Kuwait Finance House (KFH) has launched its annual Ramadan campaign, “Increase Good Deeds in Ramadan”, comprising a diverse array of social, voluntary, cultural, health, and sporting initiatives. The campaign exemplifies KFH’s ongoing commitment to the community and underscores its leading role in social responsibility.

KFH Head of Public Relations and Media, Yousef Abdullah Al-Ruwaieh stated that the campaign’s past successes have turned it into an annual tradition that embodies the values of generosity and solidarity championed by the Bank.

He explained that KFH is keen on further developing the campaign every year in collaboration and strategic partnership with the relevant entities.

Ramadan Basket (Majla)

Al-Ruwaieh explained that the campaign started with the distribution of Ramadan food basket (Ramadan Majla) to families in need, in collaboration with Kuwait Food Bank and Relief, underscoring the Bank’s efforts to strengthen social solidarity during the Holy Month of Ramadan.

Iftar Meals

He further stated that the Iftar meals initiative continues throughout the month of Ramadan. Thousands of meals, produced in certified central kitchens, are distributed daily to various locations across Kuwait.

Volunteering Team

He highlighted that KFH’s volunteering team, which consists of bank employees from different departments, is helping to distribute Iftar meals. This reflects teamwork and underscores the significance of social responsibility and volunteerism.

Hospitality service at mosques

Al-Ruwaieh added that the campaign extends to offering hospitality services at mosques during Taraweeh and Qiyam prayers during Ramadan, serving prayers and strengthening community ties.

Quran Competition

Al-Ruwaieh highlighted KFH’s commitment to continue organizing the Quran competition, the largest terms of prizes’ value and number of participants. The contest is dedicated to children and the youth from 7 to 18 years of age, and encourages the discovery of talents in Tajweed, recitation and memorization of the Holy Quran. Since its launch 14 years ago, the contest has amassed over 10,000 participants, affirming its significant impact within the community. Another competition for memorizing and reciting the Holy Quran is being held for KFH employees with valuable prizes.

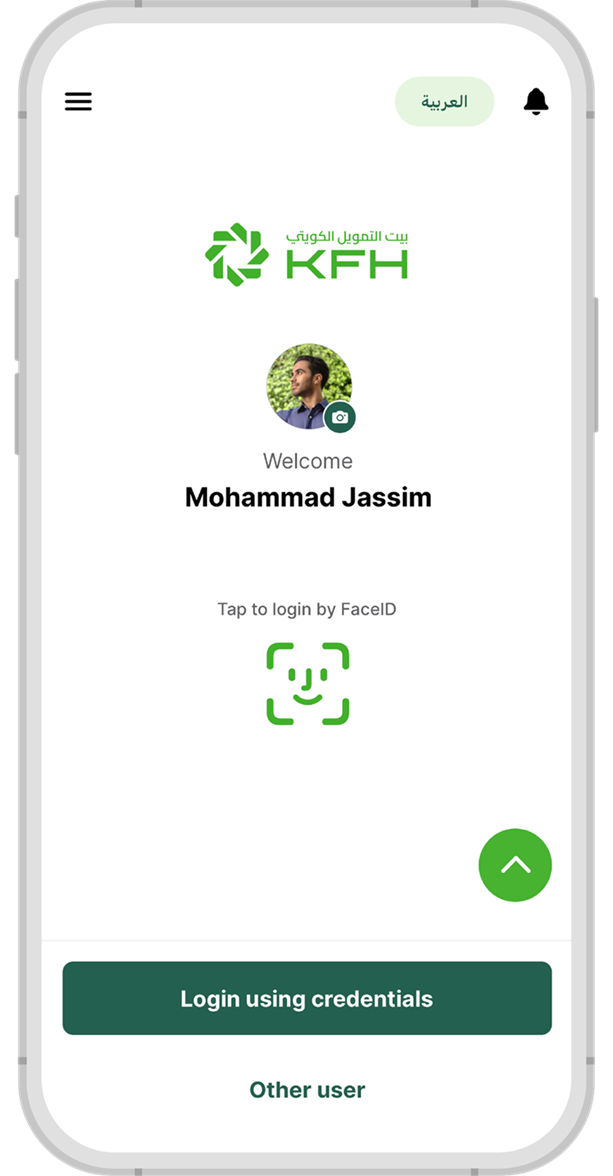

The Holy Quarn mobile app

He further highlighted the successful application of KFH, the Holy Quran app, which is available on iOS and Android platforms. The app has become one of the major reliable applications, thanks to its exclusive features and user-friendly design. It also undergoes continuous updates that contribute to improving the user’s experience and supporting Quran recitation and memorization.

Sports and Health Events

Al-Ruwaieh highlighted the Bank's commitment to organizing health and sports events during the Holy Month. Notably, KFH is sponsoring the “FASTING VS CALORIES BY KFH” tournament in cooperation with Levo Club. Held over an entire week, this initiative aims to raise health awareness, promote a culture of balanced nutrition, and create a positive environment that integrates physical activity with health education.

Cooking Courses and Healthy Home Nutrition

Al-Ruwaieh explained that KFH continues to implement its initiative for female customers and employees. This program features specialized cooking courses led by some of Kuwait’s most renowned chefs, aiming to introduce concepts of healthy home nutrition and encourage better eating habits.

Celebrating the Joy of Gergean with Children

Al-Ruwaieh emphasized that KFH remains committed to celebrating Gergean with children to help preserve Kuwait’s rich heritage and tradition. This year, the Bank’s outreach includes Sabah Al-Ahmad Cardiac Center, Kuwaiti Society for Guardians of the Disabled, and Kuwait Down Syndrome Society. Events are also scheduled at Al-Shamiya and Al-Khalidiya parks, as well as several public and private schools in partnership with Coded Academy. These efforts aim to bring joy to all children, with a special focus on patients, orphans, and those with special needs.

Sharing Iftar Meals with Government Entities

Al-Ruwaieh noted that KFH is maintaining its tradition of hosting Iftar meals for public sector employees on duty during the Holy Month. This initiative serves as a token of appreciation for their tireless efforts in ensuring public safety and serving the community around the clock.

Daily Social Media Engagement

Al-Ruwaieh explained that KFH is utilizing its social media channels throughout the Holy Month to share health awareness videos featuring specialists. This is complemented by awareness messages produced in collaboration with relevant authorities, alongside interactive competitions and comprehensive coverage of the Bank's Ramadan events.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain