KFH Offers Round-the-Clock E-services During the Holiday

Kuwait Finance House (KFH) announced it will continue providing its banking services to customers around the clock during the holiday period. Most services can be accessed through the bank's digital platforms, including its mobile applications and e-branches in key areas. Additionally, KFH's social media accounts and other e-service channels will remain active, utilizing the latest in financial technology and digital platforms.

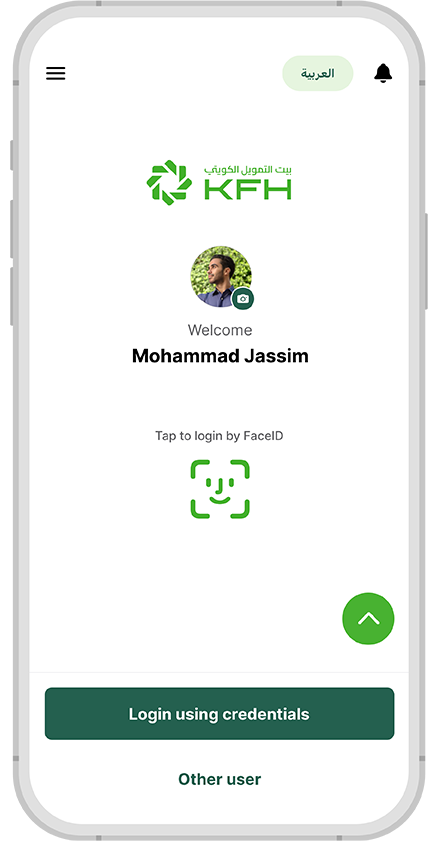

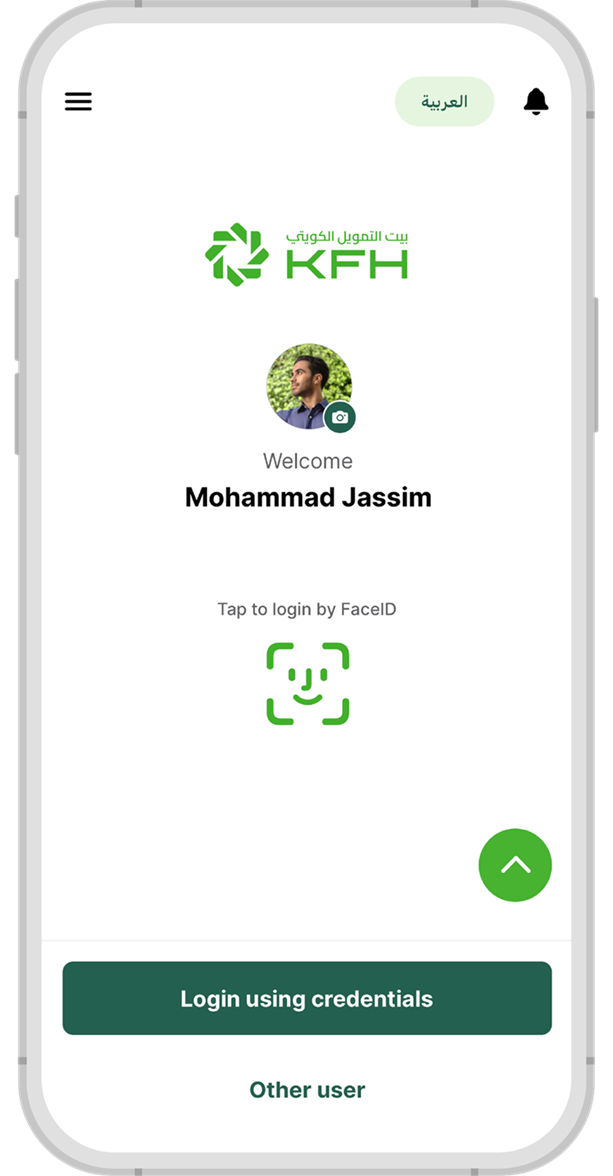

KFHOnline app features a sleek, modern design with smart banking services. KFH has carried out a comprehensive update to its app, reaffirming its dedication to digital transformation and excellence in providing advanced financial solutions. These solutions meet customer needs and deliver seamless banking experience. This move also underscores the Bank’s outstanding execution of its digital transformation strategy.

The KFHOnline app offers more than 200 banking services. New services allow customers to instantly request virtual prepaid cards through KFHOnline. Customers can also control the usage limits of their bank cards, additional credit cards, and both local and international money transfers.

KFH's hybrid branches offer a variety of services, giving customers the opportunity to access unlimited e-services through a range of digital channels. Customers can either interact directly with employees or use self-service devices and other modern technology.

KFH's e-branches are a smart banking channel that transforms typical customer transactions into an innovative, automated experience. These branches provide highly efficient banking services, offering over 80% of what is available at traditional locations.

KFH e-branches include the XTM device, which allows direct video calls with service personnel, as well as ATMs and cash deposit machines. The cash deposit machines accept up to 300 notes per transaction.

Moreover, customers can conduct a variety of interactive banking transactions through e-branches located in various places in Kuwait, These services include: establishing Murabaha transactions, requesting credit and prepaid cards, updating data and phone numbers, activating bank cards, opening deposits and accounts, instant cheque and card printing, receiving gold biscuits (10 grams), opening (gold, savings, Al-Rabeh, electron) accounts, online gold purchase and sell, cardless withdrawals using QR code through mobile, or by using Civil ID or phone number, in addition to many other financing and banking services conducted quickly, easily and safely.

The e-banking services encompass a wide array of digital functionalities, including opening additional bank account without a branch visit, instant virtual prepaid card issuance, viewing PINs and other credit and ATM card details, activating and temporarily suspending bank cards, opening deposits, adding beneficiaries, balance inquiries, cheque book requests, opening and trading gold accounts, gifting gold, requesting and checking financing obligations and installments, perusing investment plans, receiving account balances and deposit summaries, and managing children's accounts through the Baiti Online service, and more.

Call Center

The Call Center continues to provide services around the clock, receiving customer calls, addressing their inquiries, and responding to them through a qualified and technically advanced staff. KFH also provides the automated telephone service, 1803333, which operates with the same efficiency and speed to facilitate transfers between accounts, answer inquiries about financial transactions, among other services.

Customers outside Kuwait can contact KFH’s call center from seven countries (USA, Canada, UK, France, Germany, Turkey and Spain) without additional fees.

To use this service customers can call from the following toll-free numbers: USA and Canada (18008188608), UK (08000148898), France (0805086620), Germany (08001817080), Spain (900905440), and Turkey (908507712154). Local tariff charges may be applied in Turkey by local Turkish telecoms companies when calling this number.

This service is free exclusively for mobiles and landlines users in the mentioned countries only and doesn’t include the (Roaming Service).

Social media channels

KFH's social media team remains dedicated to addressing customer inquiries and assisting them at all hours through the official social media accounts (@KFHGroup).

Money transfer and account opening

KFH successfully launched WAMD digital service, allowing customers to send and receive money instantly and for free using their mobile numbers, 24/7. Additionally, customers can request money through WAMD service by sharing or scanning a QR code from the KFHOnline app. This app also allows customers to transfer funds from their local Knet bank accounts directly to their credit and prepaid cards.

KFH also successfully launched the D-POS device for account opening, the first-of-its-kind in the market, allowing customers to open accounts at KFH immediately and anywhere.

Customers can now open accounts in major currencies through KFHOnline; previously, account opening was only available at branches. Additionally, KFH has integrated Western Union (WU) services into its app, enabling customers to make international transfers directly through the application. The Bank also offers instant transfers within the GCC countries through the AFAQ network on the mobile app.

Corporate services

KFH launched the first mobile application for corporate banking encompassing major services for business development, in addition to launching facial recognition technology based on biometric identity and other distinguished electronic services available through the corporate banking webpage.

KFH successfully introduced corporate cards, offering three different products that cater to the various local and global corporate needs. Key features include cash and cheque deposits, as well as cash withdrawals. The cards also provide access to Point of Sale (POS) terminals and online payment gateways, both in Kuwait and internationally.

In addition, KFH has introduced corporate credit cards, which are among the bank’s distinguished offerings for business owners. These cards are linked directly to the company’s account, allowing business owners to issue cards to employees for seamless expense management. They can be used to cover day-to-day business expenses, one-time travel costs, and more. The corporate credit card helps businesses better manage their cash flow while offering enhanced control over employee expenditures.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain