KFH: Pioneering Efforts to Promote Financial Literacy

Reinforcing its leadership in financial literacy and social responsibility, Kuwait Finance House (KFH) continues to spearhead the national "Diraya" awareness campaign. Launched by the Central Bank of Kuwait and the Kuwait Banking Association, the initiative sees KFH deploying innovative tools and strategic outreach to strengthen financial and banking awareness across the community.

Awareness pillars

KFH geared its awareness plan towards several pillars to support Diraya campaign in response to the growing digital challenges, particularly cybersecurity and data security.

Promoting financial literacy

KFH increased its awareness messages which urged customers to refrain from responding to messages with suspicious links or sharing OTP or passwords with third parties. KFH also emphasized that banks never request personal customer information through links or phone calls.

KFH’s efforts played a prominent role in promoting financial literacy and increasing awareness as well as advising customers to remain vigilant of the cyber fraud modern methods to avoid falling victim to such practices. Furthermore, KFH advised customers to disregard any requests for banking details made through phone calls or social media, identifying such solicitations as fraudulent efforts to steal personal data and account information.

Additionally, KFH continued its awareness initiatives encouraging customers to verify the authenticity of websites prior to entering any personal information.

AI-powered fraud attempts

KFH intensified its efforts to warn the public against new fraud attempts that involve the use of advanced AI tools to replicate the voices of real individuals with a high degree of accuracy. These voice imitations are used to contact friends or family members through phone calls or social media, often accompanied by urgent requests to transfer money. The lifelike nature of these interactions may give the impression of authenticity and credibility.

KFH called for the highest levels of caution and urged customers to verify the identity of the person requesting a financial transaction.

Internal awareness

KFH’s endeavors to warn against fraud attempts encompassed sharing awareness emails to its employees. These emails present concise and engaging content aiming to raise awareness of cyber fraud risks and warn against suspicious calls that seek to deceive employees and obtain their information.

Initiatives and forums

KFH also continued its active participation in initiatives that promote banking awareness, including its support for Kuwait's largest cybersecurity hackathon for the third consecutive year. During the event, KFH highlighted the concept of fraud in general and cyber fraud in particular, addressing its various forms that pose risks to individuals and society.

Moreover, KFH participated in the 12th eGovernment Forum titled “AI-Powered Information Security Services”, demonstrating its role in reinforcing cybersecurity.

Digital channels

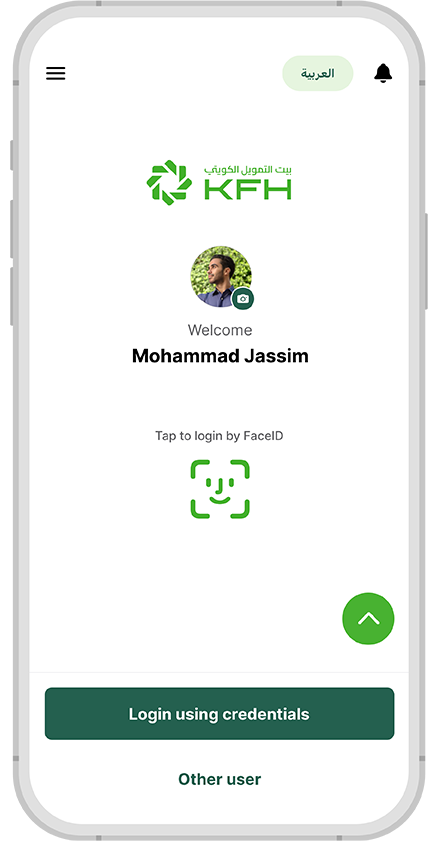

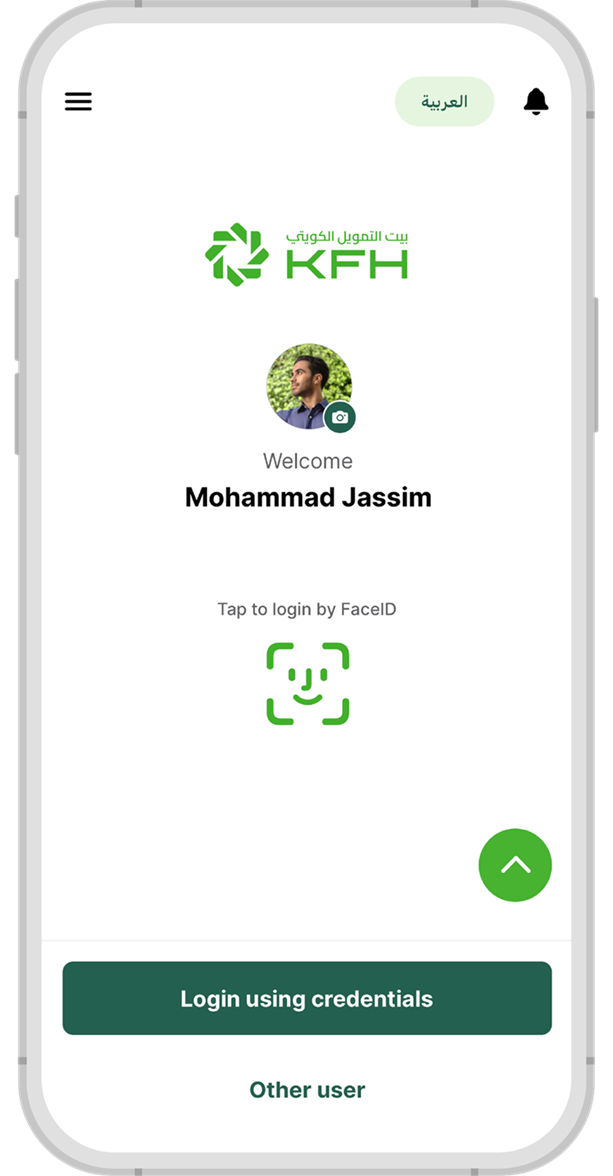

KFH recorded a significant milestone in its awareness efforts for Diraya campaign, leveraging its digital channels and official social media accounts as educational and awareness platforms for the public. Through these channels, KFH delivered distinctive awareness content.

With the introduction of its new digital services, KFH published a series of successful awareness messages on these newly launched services such as instant issuance of prepaid and credit cards, WAMD service, and instant transfers through the gulf payment system, AFAQ.

The Bank also released several educational videos on how to use and benefit from digital financial solutions available on KFHOnline, which can be viewed through its official social media accounts @kfhgroup.

Financial awareness for kids

As part of its support for the Diraya campaign, KFH partnered with Hzaya Bookstore, which specializes in children's books, to launch content dedicated to children. The initiative aims to raise awareness and teach children the basics of early savings and financial planning

In cooperation with Hzaya, KFH also organized an innovative, practical, and interactive program for Baiti account customers.

Social engagement and measurable impact

Reaffirming its leadership in supporting Diraya campaign, KFH continued its initiatives to measure banking awareness among the public through several programs and activities. These included awareness initiatives for its PR Academy participants, Kuwait University students, students participating in Ma’a Attalaba competition, as well as participants in the Derasti Exhibition, held at Kuwait International Fair in Mishref. KFH also organized awareness programs for CODED Academy students during the Bank’s participation in the Kuwait Codes initiative.

Record engagement levels

KFH’s efforts in supporting Diraya campaign resulted in achieving record engagement levels, with awareness messages reaching millions of followers. This contributed effectively to changing financial behavior toward greater caution and awareness.

It is also worth noting that KFH, through its leading role in Diraya campaign, reiterates its pivotal role in prioritizing customers and public safety. Additionally, the success in spreading digital and banking awareness reflects KFH’s pioneering vision of transforming its platforms into educational channels that contribute to creating a safe and sustainable financial environment.

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain