بيت التمويل الكويتي يطلق خدمة التفويض الإلكتروني للاستعلام الائتماني عبر تطبيق “هويتي”

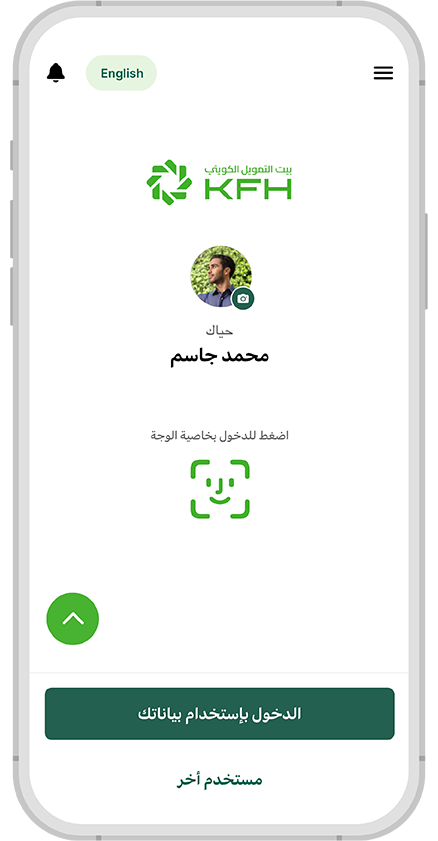

أعلن بيت التمويل الكويتي عن إطلاق خدمة التفويض الإلكتروني للاستعلام الائتماني بالتعاون مع شركة CiNet، وذلك لعملاء التمويل الاستهلاكي والإسكاني عبر تطبيق “هويتي”، في إطار جهوده المتواصلة نحو تطوير خدماته الرقمية وتعزيز كفاءة الإجراءات المصرفية.

وتتيح الخدمة الجديدة للعملاء إمكانية منح التفويض للاستعلام الائتماني بصورة رقمية ، بما يسهم في تبسيط الإجراءات وتقليص الاعتماد على المستندات الورقية ، وبما يواكب توجهات الدولة نحو التحول الرقمي.

وقال المدير التنفيذي للمنتجات التمويلية للأفراد في بيت التمويل الكويتي، عبد العزيز السعيد، إن إطلاق هذه الخدمة يأتي ضمن استراتيجية البنك الرامية إلى تقديم حلول مصرفية رقمية متطورة ، تسهم في تحسين تجربة العملاء وتعزيز مستويات السرعة والمرونة في تنفيذ المعاملات.

وأوضح السعيد أن الخدمة تمكّن العملاء من إتمام إجراءات التفويض بسهولة وأمان عبر تطبيق “هويتي”، دون الحاجة إلى التوقيع الورقي ، الأمر الذي ينعكس إيجابًا على زمن إنجاز الطلبات ويعزز كفاءة سير المعاملات.

وأشار إلى أن التفويض الإلكتروني يُعد خيارًا إضافيًا يقدمه البنك إلى جانب التفويض الورقي ، بما يمنح العملاء مرونة أكبر في اختيار الآلية المناسبة لهم ، مؤكدًا التزام بيت التمويل الكويتي بمواصلة تطوير خدماته الرقمية بما يتوافق مع أفضل الممارسات المصرفية.

وأضاف أن الخدمة تمثل خطوة مهمة في دعم المعاملات الرقمية وتعزيز الاستدامة البيئية ، من خلال تقليص استخدام الورق والاستفادة من الحلول التقنية الحديثة.

ألمانيا

ألمانيا ماليزيا

ماليزيا تركيا

تركيا مصر

مصر المملكة المتحدة

المملكة المتحدة مملكة البحرين

مملكة البحرين