Q&A on Tawarruq

What is Tawarruq?

Tawarruq is a financing arrangement where customer will be receiving cash at the end of it for his needs through a series of sale transactions.

How Tawarruq is done?

The bank will purchase commodities from a supplier (first sale) and sells them to customer (second sale). The customer then, will sell the commodities to a different supplier to get the required cash(third sale).

Is Tawarruq a Murabaha?

Tawarruq is the whole financing arrangement to get cash whereas Murabaha is the most common sale contract used between the Bank and the customer (second sale).

What commodities could be used in Tawarruq?

All commodities except for gold and silver are suitable for Tawarruq but usually metals, palm oil and others are being used.

What is the role of brokerage in Tawarruq?

If the Tawarruq is done through an online trading platform, a broker (in place of supplier) will sell the commodities to the Bank whilst another broker will purchase them from the customer to complete the process.

What is the Shari’a ruling on Tawarruq?

Tawarruq is permissible as long as all three sale transactions (the first, second and third sale) satisfy the Shari’a requirements of a valid sale in addition to the customer selling the commodities to a different supplier in the third sale.

When would Tawarruq is considered invalid?

It is considered invalid upon not observing the Sharia requirements such as existence of commodities, taking ownership and possession of commodities before selling them and not selling to the same supplier twice.

What is done to ensure that the sales in Tawarruq observed the Shari’a requirements?

Every sale in Tawarruq is properly executed and documented to evidence that the commodities exist, ownership transfer, possession taking and other requirements apart from conducting Shari’a audit on every stage of the transaction.

Can the customer appoint an agent to sell the commodities on his behalf in the third sale?

The customer may appoint an agent to sell the commodities on his behalf and should preferably someone other than the seller of the second sale (the Bank).

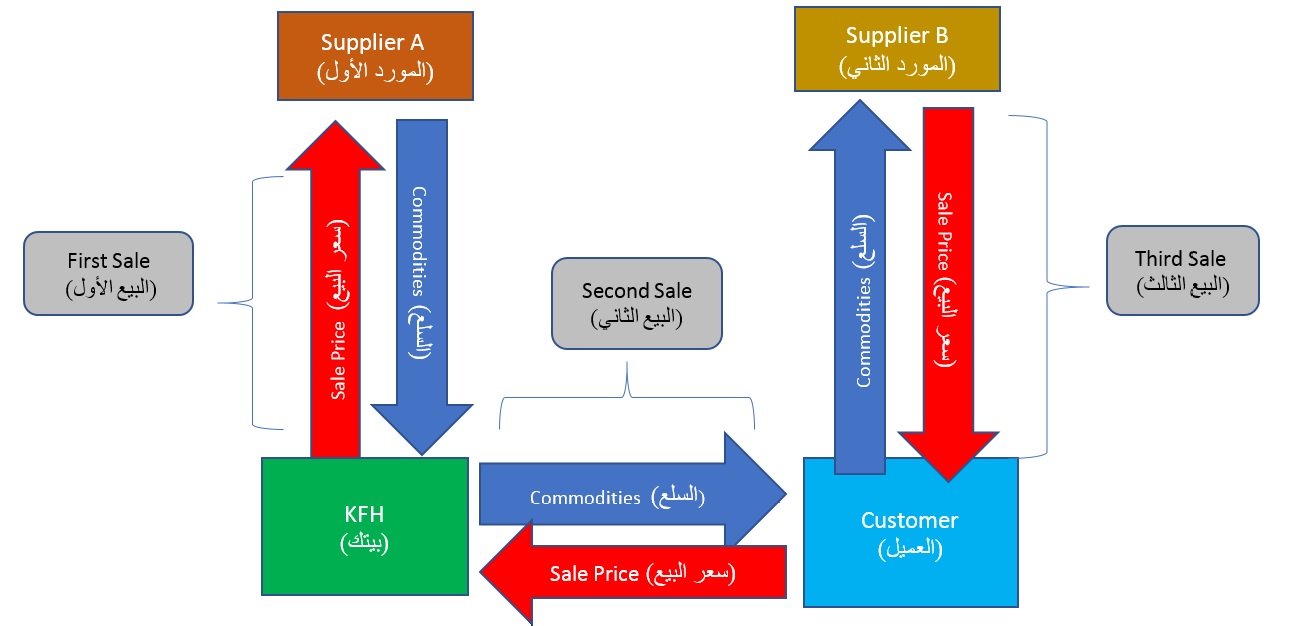

- KFH will purchase commodities from Supplier A based and pay the sale price on spot. (First Sale)

- After owning the commodities, KFH will sell them to Customer based on Murabaha but sale price will be paid on deferred. (Second Sale)

- After owning the commodities, Customer (or through his agent) sells them to Supplier B and will be paid the sale price immediately. (Third Sale)

Germany

Germany Malaysia

Malaysia Turkey

Turkey Egypt

Egypt UK

UK Kingdom of Bahrain

Kingdom of Bahrain